- credit_bureau_a_2 : (188298452, 19)

- static_cb_0 : (1500476, 53)

- applprev_1 : (6525979, 41)

credit_bureau_a_2

(188298452, 19)

columns

- 'case_id'

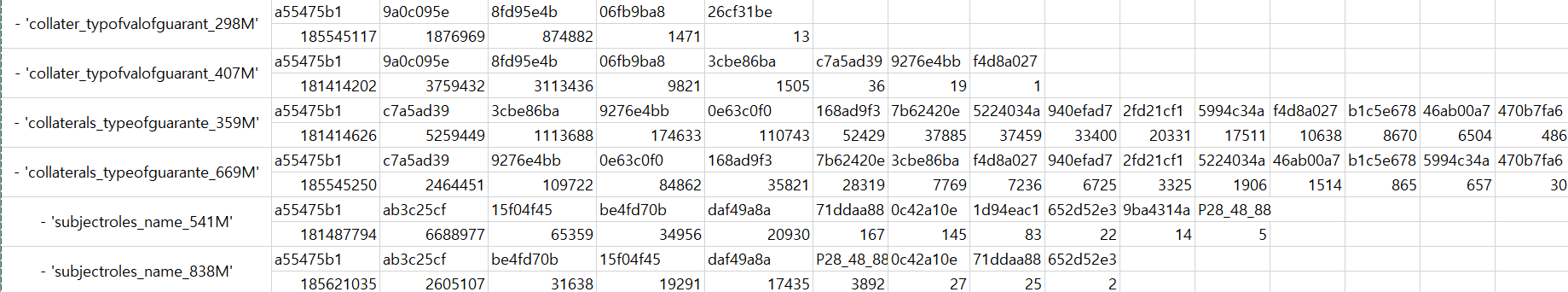

- 'collater_typofvalofguarant_298M' : Collateral valuation type (active contract).

- 'collater_typofvalofguarant_407M' : Collateral valuation type (closed contract).

- 'collater_valueofguarantee_1124L' : Value of collateral for active contract.

- 'collater_valueofguarantee_876L' : Value of collateral for closed contract.

- 'collaterals_typeofguarante_359M' : Type of collateral that was used as a guarantee for a closed contract.

- 'collaterals_typeofguarante_669M' : Collateral type for the active contract.

- 'num_group1'

- 'num_group2'

- 'pmts_dpd_1073P' : Days past due of the payment for the active contract

(num_group1 - existing contract, num_group2 - payment).

- 'pmts_dpd_303P' : Days past due of the payment for terminated contract according to credit bureau

(num_group1 - terminated contract, num_group2 - payment).

- 'pmts_month_158T' : Month of payment for a closed contract

(num_group1 - existing contract, num_group2 - payment).

- 'pmts_month_706T' : Month of payment for active contract (num_group1 - terminated contract, num_group2 - payment).

- 'pmts_overdue_1140A' : Overdue payment for an active contract (num_group1 - existing contract, num_group2 - payment).

- 'pmts_overdue_1152A' : Overdue payment for a closed contract (num_group1 - terminated contract, num_group2 - payment).

- 'pmts_year_1139T' : Year of payment for an active contract (num_group1 - existing contract, num_group2 - payment).

- 'pmts_year_507T' : Payment year for a closed credit contract (num_group1 - terminated contract, num_group2 - payment).

- 'subjectroles_name_541M' : Name of subject role in closed credit contract (num_group1 - terminated contract, num_group2 - subject roles).

- 'subjectroles_name_838M' : Name of subject role in active credit contract (num_group1 - existing contract, num_group2 - subject roles).

| active contract | closed contract | ||

| Collateral | valuation type | 298M | 407M |

| Value | 1124L | 876L | |

| Type | 669M | 359M | |

| DPD | 1073P | 303P | |

| Month of payment | 158T | 706T | |

| Overdue payment | 1140A | 1152A | |

| Year of payment | 1139T | 507T | |

| subject role | 838M | 541M | |

collateral : 담보

| data type | null_유무 | null 개수 | null 비율 | 0 개수 | nunique | ||

| - 'case_id' | int64 | FALSE | 0 | 0.00 | 0 | 1,385,288 | |

| - 'collater_typofvalofguarant_298M' | M | object | FALSE | 0 | 0.00 | 0 | 5 |

| - 'collater_typofvalofguarant_407M' | M | object | FALSE | 0 | 0.00 | 0 | 8 |

| - 'collater_valueofguarantee_1124L' | L | float64 | TRUE | 185,545,117 | 0.99 | 2,545,706 | 83,274 |

| - 'collater_valueofguarantee_876L' | L | float64 | TRUE | 181,414,202 | 0.96 | 6,155,687 | 148,992 |

| - 'collaterals_typeofguarante_359M' | M | object | FALSE | 0 | 0.00 | 15 | |

| - 'collaterals_typeofguarante_669M' | M | object | FALSE | 0 | 0.00 | 15 | |

| - 'num_group1' | int64 | FALSE | 0 | 0.00 | 333 | ||

| - 'num_group2' | int64 | FALSE | 0 | 0.00 | 101 | ||

| - 'pmts_dpd_1073P' | P | float64 | TRUE | 152,991,152 | 0.81 | 33,295,090 | 4,414 |

| - 'pmts_dpd_303P' | P | float64 | TRUE | 113,465,446 | 0.60 | 62,769,627 | 4,771 |

| - 'pmts_month_158T' | T | float64 | TRUE | 122,168,636 | 0.65 | 0 | 12 |

| - 'pmts_month_706T' | T | float64 | TRUE | 29,568,980 | 0.16 | 0 | 12 |

| - 'pmts_overdue_1140A' | A | float64 | TRUE | 152,850,520 | 0.81 | 33,402,002 | 1,115,375 |

| - 'pmts_overdue_1152A' | A | float64 | TRUE | 113,377,640 | 0.60 | 62,326,665 | 3,260,905 |

| - 'pmts_year_1139T' | T | float64 | TRUE | 122,168,636 | 0.65 | 0 | 13 |

| - 'pmts_year_507T' | T | float64 | TRUE | 29,568,980 | 0.16 | 0 | 26 |

| - 'subjectroles_name_541M' | M | object | FALSE | 0 | 0.00 | 0 | 11 |

| - 'subjectroles_name_838M' | M | object | FALSE | 0 | 0.00 | 0 | 9 |

int 로변환해도 되는 컬럼

- 'pmts_month_158T'

- 'pmts_month_706T'

- 'pmts_year_1139T'

- 'pmts_year_507T'

기타 특이사항

- 'pmts_month_158T' : 모든 value count가 5510818로 동일

- 'pmts_month_706T' : 모든 value count가 13227456로 동일

a55475b1이 null일지도???

credit_bureau_a_2.case_id.value_counts()

| case_id | value_counts |

| 214097 | 9404 |

| 221467 | 7859 |

| 973076 | 6764 |

| 1706379 | 5986 |

| 941237 | 4968 |

| ... | |

| 1285135 | 12 |

| 937186 | 12 |

| 631714 | 12 |

| 774521 | 2 |

| 218801 | 1 |

Name: case_id, Length: 1385288, dtype: int64

bureau에 정보가 많다는 건 무슨 뜻일까?

마스킹된 데이터는 그 값이 무슨 의미인지 찾기보다 그 값에 따른 경향을 봐야할 듯

static_cb_0

(1500476, 53)

- case_id

- assignmentdate_238D : Tax authority data - date of assignment.

- assignmentdate_4527235D : Tax authority data - Date of assignment.

- assignmentdate_4955616D : Tax authority assignment date.

- birthdate_574D : Client's date of birth (credit bureau data).

- contractssum_5085716L : Total sum of values of contracts retrieved from external credit bureau.

- dateofbirth_337D : Client's date of birth.

- dateofbirth_342D : Client's date of birth.

- days120_123L : Number of credit bureau queries for the last 120 days.

- days180_256L : Number of credit bureau queries for last 180 days.

- days30_165L : Number of credit bureau queries for the last 30 days.

- days360_512L : Number of Credit Bureau queries for last 360 days.

- days90_310L : Number of credit bureau queries for the last 90 days.

- description_5085714M : Categorization of clients by credit bureau.

- education_1103M : Level of education of the client provided by external source.

- education_88M : Education level of the client.

- firstquarter_103L : Number of results obtained from credit bureau in the first quarter.

- for3years_128L : Number of rejected applications in the past 3 years.

- for3years_504L : Client's credit history data over the last three years.

- for3years_584L : Number of cancellations in the last 3 years.

- formonth_118L : Number of rejections in a month.

- formonth_206L : Number of cancelations in the previous month.

- formonth_535L : Credit history for the last month.

- forquarter_1017L : Number of cancellations recorded in the credit bureau in the last quarter.

- forquarter_462L : Number of credit applications that were rejected in the last quarter.

- forquarter_634L : Credit history for the last quarter.

- fortoday_1092L : Client's credit history for today.

- forweek_1077L : Number of cancelations in the last week.

- forweek_528L : Credit history for the last week.

- forweek_601L : Number of rejected applications in the last week.

- foryear_618L : Number of application rejections in the previous year.

- foryear_818L : Number of cancelations that occurred in last year.

- foryear_850L : Credit history for the last year.

- fourthquarter_440L : Number of results in fourth quarter.

- maritalst_385M : Marital status of the client.

- maritalst_893M : Marital status of the client.

- numberofqueries_373L : Number of queries to credit bureau.

- pmtaverage_3A : Average of tax deductions.

- pmtaverage_4527227A : Average of tax deductions.

- pmtaverage_4955615A : Average of tax deductions.

- pmtcount_4527229L : Number of tax deductions.

- pmtcount_4955617L : Number of tax deductions.

- pmtcount_693L : Number of tax deductions.

- pmtscount_423L : Number of tax deduction payments.

- pmtssum_45A : Sum of tax deductions for the client.

- requesttype_4525192L : Tax authority request type.

- responsedate_1012D : Tax authority's response date.

- responsedate_4527233D : Tax authority's response date.

- responsedate_4917613D : Tax authority's response date.

- riskassesment_302T : Estimated probability that the client will default on their credit obligation within the next year.

- riskassesment_940T : Estimate of client's creditworthiness.

- secondquarter_766L : Number of results in second quarter.

- thirdquarter_1082L : Number of results in third quarter.

tax deductions : 세금 공제액

L 32

D 9

M 5

A 4

T 2

- days30_165L : Number of credit bureau queries for the last 30 days.

- days90_310L : Number of credit bureau queries for the last 90 days.

- days120_123L : Number of credit bureau queries for the last 120 days.

- days180_256L : Number of credit bureau queries for last 180 days.

- days360_512L : Number of Credit Bureau queries for last 360 days.

- numberofqueries_373L : Number of queries to credit bureau.

- pmtcount_4527229L : Number of tax deductions.

- pmtcount_4955617L : Number of tax deductions.

- pmtcount_693L : Number of tax deductions.

| rejections | cancellations | Credit history | |

| in the last 3 years. | 128L | 584L | 504L |

| in the previous month. | 118L | 206L | 535L |

| in the last quarter. | 462L | 1017L | 634L |

| in the last week | 601L | 1077L | 528L |

| in the previous year. | 618L | 818L | 850L |

| fortoday | 1092L |

| quarter_1 | 103L |

| quarter_2 | 766L |

| quarter_3 | 1082L |

| quarter_4 | 440L |

| assignment date(tax authority) | 238D | 4527235D | 4955616D |

| date of birth | 574D (credit bureau data) |

337D | 342D |

| 30 | 90 | 120 | 180 | 360 | total? | |

| num of queries | 165L | 310L | 123L | 256L | 512L | 373L |

| education | 1103M | 88M |

| marital status | 385M | 893M |

| Average of tax deductions. | 3A | 4527227A | 4955615A | ||

| Number of tax deductions. | 4527229L | 4955617L | 693L | 423L | 45A (sum) |

| request type. | 4525192L | ||

| response date | 1012D | 4527233D | 4917613D |

| probability of default | 302T |

| creditworthiness. | 940T |

train_static_cb_0.columns[6]

dateofbirth_337D

null : 114785

count 합계 : 1385691

train_static_cb_0.columns[7]

dateofbirth_342D

null : 1463976

count 합계 : 36500

왜 같은 dateofbirth 컬럼이 두개가 있는지....?

null값 114785개가 반복되는 것 같음

null값 1463962개도 몇번 반복됨

cancellation과 rejection의 차이?

cancellation / rejection / credit history - 기간을 조금씩 다르게 하여 컬럼들이 있음, 기간들을 하나의 수치로 변환해서 한개의 컬럼으로 만든다든가 등의 조작이 가능할 것 같음

Average of tax deductions.

#### 37_train_static_cb_0.pmtaverage_3A

#### 38_train_static_cb_0.pmtaverage_4527227A

#### 39_train_static_cb_0.pmtaverage_4955615A

Number of tax deductions.

#### 40_train_static_cb_0.pmtcount_4527229L

#### 41_train_static_cb_0.pmtcount_4955617L

#### 42_train_static_cb_0.pmtcount_693L

#### 45_train_static_cb_0.requesttype_4525192L

- Tax authority request type.

데이터 타입은? object

NA 값이 있나요? (True, 827212, 0.5512997208885714)

분포는?

DEDUCTION_6 550387

PENSION_6 117047

SOCIAL_6 5830

Name: requesttype_4525192L, dtype: int64

합계 : 673264

count 최소 최대: (5830, 550387)

num of unique values : 3

Tax authority's response date.

#### 46_train_static_cb_0.responsedate_1012D

#### 47_train_static_cb_0.responsedate_4527233D

#### 48_train_static_cb_0.responsedate_4917613D

#### 49_train_static_cb_0.riskassesment_302T

- 302T

- Estimated probability that the client will default on their credit obligation within the next year.

데이터 타입은? object

NA 값이 있나요? (True, 1446917, 0.9643053271095305)

분포는?

3% - 4% 6445

2% - 3% 6147

4% - 6% 5681

2% - 2% 4948

6% - 8% 4561

67% - 100% 4549

1% - 1% 4103

8% - 11% 3922

11% - 15% 2989

15% - 19% 2244

20% - 25% 1569

33% - 41% 1556

26% - 33% 1495

41% - 49% 1370

50% - 58% 1187

59% - 66% 793

Name: riskassesment_302T, dtype: int64

합계 : 53559

count 최소 최대: (793, 6445)

num of unique values : 16

encoding 필요

downpayment : 착수금? 계약금?

분명 case_id로 합쳐야하는데.... mean을 해야하는 컬럼과, sum을 해야하는 컬럼이 아직 감이 안 잡힘

아직 num_group1, num_group2의 분포를 모르겠음

applprev_1

(6525979, 41)

- 'case_id'

- 'actualdpd_943P' :

- 'annuity_853A'

- 'approvaldate_319D'

- 'byoccupationinc_3656910L'

- 'cancelreason_3545846M'

- 'childnum_21L'

- 'creationdate_885D'

- 'credacc_actualbalance_314A'

- 'credacc_credlmt_575A'

- 'credacc_maxhisbal_375A'

- 'credacc_minhisbal_90A'

- 'credacc_status_367L'

- 'credacc_transactions_402L'

- 'credamount_590A'

- 'credtype_587L'

- 'currdebt_94A'

- 'dateactivated_425D'

- 'district_544M'

- 'downpmt_134A'

- 'dtlastpmt_581D'

- 'dtlastpmtallstes_3545839D'

- 'education_1138M'

- 'employedfrom_700D'

- 'familystate_726L'

- 'firstnonzeroinstldate_307D'

- 'inittransactioncode_279L'

- 'isbidproduct_390L'

- 'isdebitcard_527L'

- 'mainoccupationinc_437A'

- 'maxdpdtolerance_577P'

- 'num_group1'

- 'outstandingdebt_522A'

- 'pmtnum_8L'

- 'postype_4733339M'

- 'profession_152M'

- 'rejectreason_755M'

- 'rejectreasonclient_4145042M'

- 'revolvingaccount_394A'

- 'status_219L'

- 'tenor_203L'

todo

- data 찍어보기

credit_bureau_a_2static_cb_0applprev_1

- home credit wiki 읽어보기

- 찍어본 data의 의미 파악하기

null 시각화 잘 되어있는 discussion

https://www.kaggle.com/competitions/home-credit-credit-risk-model-stability/discussion/473950

variables, description, dtype, tables

https://www.kaggle.com/competitions/home-credit-credit-risk-model-stability/discussion/475922

https://www.kaggle.com/competitions/home-credit-credit-risk-model-stability/discussion/475695

'Upstage AI Lab 2기' 카테고리의 다른 글

| Upstage AI Lab 2기 [Day055] Deep Learning - 손실 함수 (0) | 2024.03.03 |

|---|---|

| Upstage AI Lab 2기 [Day055] Deep Learning (1) | 2024.02.29 |

| Upstage AI Lab 2기 [Day043] ML 프로젝트 (day1) (0) | 2024.02.13 |

| Upstage AI Lab 2기 [Day042] 자료구조 및 알고리즘 (3) (0) | 2024.02.09 |

| Upstage AI Lab 2기 [Day041] 자료구조 및 알고리즘 (2) (0) | 2024.02.07 |